If you are deciding between a centralized exchange (CEX) and a decentralized exchange (DEX), you’re not alone. Every day, global users search for the best crypto exchange to buy Bitcoin, swap stablecoins, or cash out to a bank card with low exchange fees. This guide explains how CEX and DEX work, what risks and benefits to expect, how to choose trusted crypto exchangers, and how ExFinder.io helps you discover top crypto exchangers worldwide without wasting hours comparing offers.

What Are Crypto Exchanges and Why Do We Need Them?

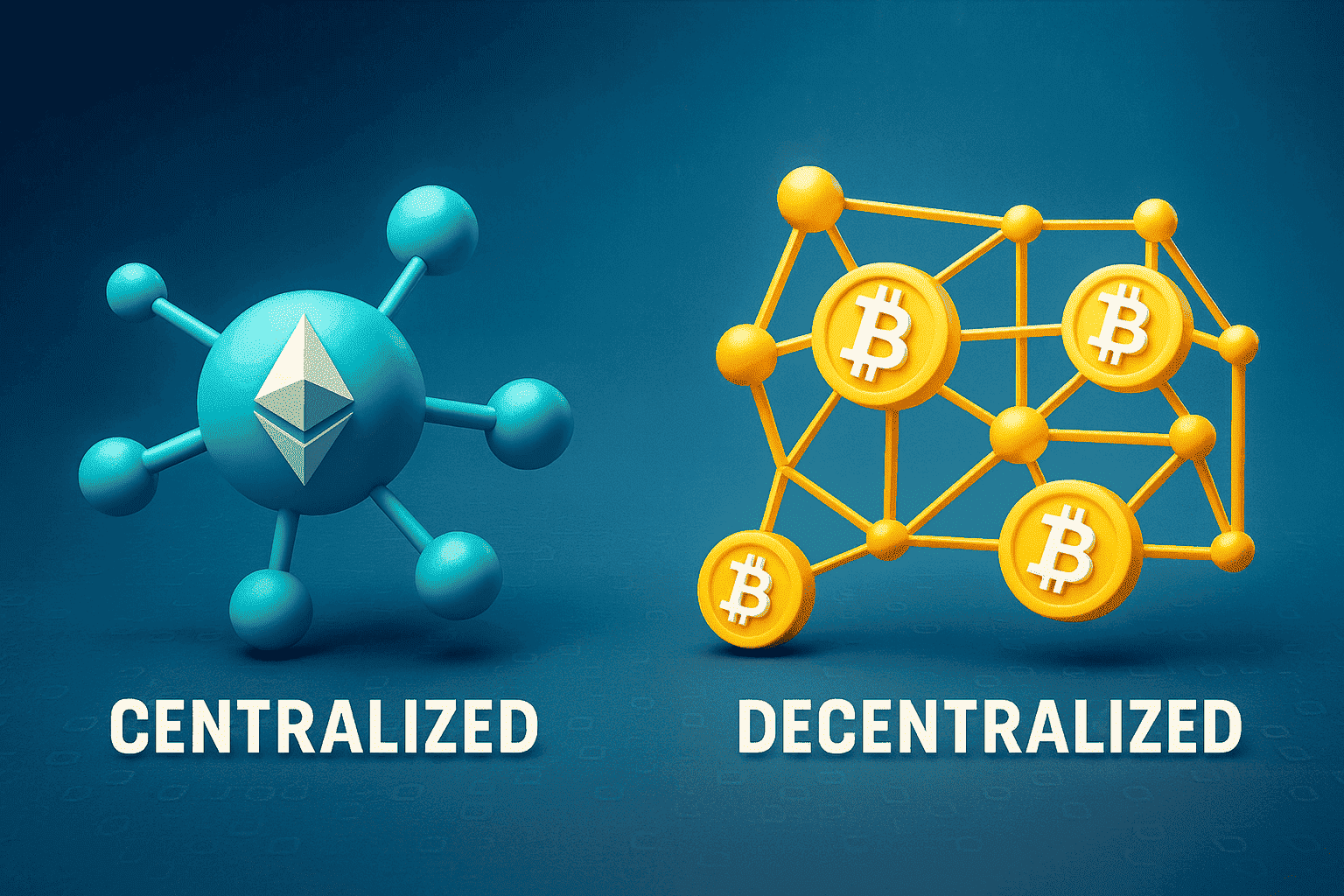

Crypto exchanges are marketplaces that match buyers and sellers of digital assets. In a CEX model, a company operates order books, custody infrastructure, and compliance programs so users can trade quickly and settle balances within the platform. In a DEX model, smart contracts act as the marketplace and users keep custody of their funds inside non-custodial wallets. Both models aim to provide liquidity, price discovery, and execution, but they optimize for different user needs such as convenience, privacy, control, and access to fiat on- and off-ramps.

Beyond the mechanics, exchanges are essential for market efficiency. They aggregate liquidity, standardize quoting, and expose transparent fees so that crypto owners can convert assets into other coins or fiat with predictable results. A reliable venue is critical when your goal is to buy Bitcoin profitably, rebalance a portfolio, hedge risk, or move funds across chains. For newcomers, the exchange is often the first touchpoint, which is why user experience, security standards, and clear fee disclosures matter as much as raw price.

Centralized Exchanges (CEX)

Centralized exchanges are run by legal entities with compliance teams, customer support, and integrated payment rails. Users create accounts, pass KYC, deposit fiat or crypto, and trade through order books or market makers. Settlement is fast because balances are updated internally, and withdrawals occur when you choose to move assets on-chain or to a bank account.

Because CEX platforms control custody, they can offer quality-of-life features: recurring buys, card top-ups, instant conversions, advanced charting, leveraged products, staking, and earn programs. They also tend to list fiat pairs, enabling straightforward purchases using debit cards, bank transfers (ACH, SEPA, Faster Payments), or alternative payment methods depending on region. For a broad audience, this convenience means a lower learning curve and faster time to completion.

Advantages of CEX

- High liquidity and fast execution. Deep order books on leading platforms reduce slippage on large trades and make market prices more predictable for retail users.

- Global fiat support. On-ramps and off-ramps in USD, EUR, GBP, and more simplify the fiat-to-crypto exchange journey, which is crucial for first-time buyers.

- Robust tooling. Mobile apps, API access, conditional orders, and advanced analytics make CEX suitable for both beginners and professionals.

- Customer support. Ticketing systems, help centers, and fraud response teams can resolve issues faster than pure on-chain solutions.

Disadvantages of CEX

- Custody risk. “Not your keys, not your coins.” If an exchange is compromised or mismanaged, your funds may be at risk until withdrawn to self-custody.

- Reduced privacy. KYC/AML checks are standard, which is acceptable for many but not ideal for users who value maximum anonymity.

- Regulatory exposure. Regional policy shifts can affect available services, asset listings, or withdrawal terms.

Decentralized Exchanges (DEX)

Decentralized exchanges operate through smart contracts on public blockchains. Instead of a company matching orders, Automated Market Makers (AMMs) provide liquidity pools where prices are determined by algorithmic formulas and arbitrage. Users connect wallets like MetaMask or Ledger, approve token allowances, and swap directly on-chain. No account creation or personal data is required to start a trade.

DEX ecosystems have grown beyond simple swaps. There are cross-chain bridges, limit-order protocols, DEX aggregators that find the best route across multiple pools, and liquidity incentives for providers. With self-custody, you decide when and how to move assets; however, you also take responsibility for seed phrases, approvals, and gas fees. For many, this autonomy aligns with the original crypto ethos and offers higher resilience against centralized outages or censorship.

Advantages of DEX

- Self-custody by default. You keep your private keys, so counterparty risk is minimized compared to custodial environments.

- Greater privacy. Most DEXs have no KYC; activity is visible on-chain but not tied to identity unless you share it.

- Open access. Anyone with a compatible wallet and gas can trade, list tokens, or add liquidity, accelerating innovation.

- Composability. DEXs integrate with DeFi apps—lending protocols, yield optimizers, and on-chain analytics—creating new strategies unavailable on CEX.

Disadvantages of DEX

- Variable fees and delays. Network congestion can make transactions slow and expensive, especially on high-demand chains.

- Smart contract risk. Bugs or economic exploits can drain pools or create unfair outcomes if code is not audited or battle-tested.

- UX complexity. Wallet setup, chain selection, slippage configuration, and approvals raise the learning curve for non-technical users.

- Limited direct fiat access. To purchase with cash, you often need external on-ramps before swapping on a DEX.

Comparison Table: CEX vs DEX

| Criterion | CEX | DEX |

|---|---|---|

| Asset control | Custodial (exchange holds funds) | Non-custodial (user holds funds) |

| Fiat access | Integrated on/off-ramps | Usually crypto-only; external on-ramps |

| Liquidity | Deep order books on top venues | Depends on pool depth and incentives |

| Fees | Trading + deposit/withdrawal fees | Gas fees + protocol fees |

| Privacy | KYC/AML required | No account/KYC in most cases |

| Speed | Fast internal settlement | Network-dependent confirmation |

| Product variety | Spot, margin, derivatives, staking | Swaps, LP, yield, on-chain routing |

| Support | Help desk and dispute handling | Docs and community support |

How ExFinder.io Differs from CEX and DEX

ExFinder.io is a neutral listing and comparison platform—not a trading venue. Instead of holding funds, ExFinder.io curates data on trusted crypto exchangers and highlights where you can find the best crypto exchange offers for a specific direction and payment method. Whether you’re converting USD to USDT, swapping BTC to ETH, or cashing out to a bank transfer, ExFinder.io helps you compare rates, limits, speed, and user ratings in one place.

This approach saves time and reduces risk. You avoid unknown websites and narrow down to vetted providers with transparent terms. For power users, the listing also reveals niche routes—like finding low fees crypto exchange options on specific networks (e.g., TRON or Polygon) or locating exchangers that support particular payment rails in your region. For beginners, it answers a simple question: “Where can I buy Bitcoin today with the best net result after fees?”

Benefits of Using ExFinder.io

- Real-time comparison. See current rates and total costs across multiple providers without opening dozens of tabs.

- Verified partners. Listings prioritize reliable crypto exchangers with a track record, clear policies, and consistent support.

- Smart filtering. Filter by direction (fiat-to-crypto, crypto-to-fiat, crypto-to-crypto), currency, payment method, network, and region.

- User insights. Ratings and reviews surface practical details like processing speed, KYC friction, and typical limits.

- Discovery of deals. Identify routes with low exchange fees and favorable spreads to maximize what you receive “in hand”.

How to Choose the Best Exchange for Your Needs

Start with a clear goal. Do you need a fast fiat on-ramp to purchase BTC, or a private crypto-to-crypto swap without KYC? Are you moving a small amount for testing or a large amount that requires deep liquidity and bank-grade settlement? Goals determine whether CEX or DEX fits best, and ExFinder.io turns those goals into filters you can apply immediately.

- Compare effective price. Look at the final “you pay → you receive” after all commissions. The cheapest sticker fee isn’t always the best deal.

- Check reputation and history. A trusted crypto exchanger should have a consistent rating and clear support channels.

- Assess speed and limits. Some providers are instant for small amounts but add delays for larger tickets or specific payment methods.

- Match the network. If you withdraw USDT on TRC-20 but deposit to an ERC-20 address, funds may be lost. Always align networks.

- Run a small test. Before sending a large amount, try a small transaction to confirm the flow and settlement time.

Cost Components: Fees, Spreads, and Hidden Charges

Total cost includes trading fees (or protocol fees), spreads, deposit and withdrawal charges, and possible card or bank surcharges. On CEX, fees are usually tiered by volume; makers often pay less than takers. On DEX, gas costs vary by chain, and swaps may route across multiple pools, each adding a small protocol fee. If your priority is a low fees crypto exchange, choose networks with inexpensive gas, avoid unnecessary hops, and pay attention to minimum/maximum amounts that could trigger extra charges.

Also consider slippage—the difference between the price you expect and the price you get. On shallow markets or volatile assets, slippage can exceed fees. ExFinder.io helps surface exchangers and routes where depth is adequate for your order size, keeping slippage under control.

Security and Risk Management

Security is not a single feature; it’s a stack. On CEX, enable 2FA, withdrawal address whitelists, and device approvals. Use strong unique passwords and avoid email reuse. On DEX, verify contract addresses, use hardware wallets for significant assets, and limit token allowances after completing swaps. Always bookmark official URLs and double-check SSL certificates to avoid phishing.

For large transactions, split the amount into tranches and confirm each step. Keep detailed records of transaction IDs, amounts, and counterparties for accounting and potential dispute resolution. These practices help protect your funds regardless of platform.

Deeper Comparison: Convenience, Access, and Product Scope

| Area | CEX Notes | DEX Notes |

|---|---|---|

| Onboarding | Account + KYC; easy card/bank funding | Wallet connection; gas setup; no KYC |

| User Experience | Guided flows, mobile apps, fiat pairs | Technical UI; slippage and approval steps |

| Security Model | Custodial; platform security + 2FA | Self-custody; key management is critical |

| Derivatives | Futures, options, leverage | On-chain perps exist but require expertise |

| Compliance | Regulated; geo-features vary by region | Protocol-level; front-ends may add geo gates |

Practical Examples and Use Cases

1) Buy Bitcoin with a debit card

Your priority is speed and simplicity. A CEX or a verified fiat on-ramp listed on ExFinder.io is typically the fastest route. Compare effective rates, card processing fees, and instant availability. After purchase, consider withdrawing BTC to a self-custodial wallet for long-term storage.

2) Private crypto-to-crypto swap

You already hold ETH and want USDT without sharing personal data. A DEX swap via a reputable aggregator can deliver the best route across pools. Check the quoted slippage, gas estimate, and token approvals; revoke approvals later if you won’t reuse them.

3) Cash out to bank

You need to move USDT to a bank account in your local currency. Use ExFinder.io to find exchangers supporting your payment rail with favorable limits and timing. Some services process small tickets instantly but require extra verification for larger withdrawals—plan accordingly.

Common Mistakes to Avoid

- Ignoring minimum/maximum limits or processing windows.

- Sending funds to the wrong network (ERC-20 vs TRC-20 vs BEP-20).

- Chasing the lowest headline fee without factoring in spreads and slippage.

- Skipping test transactions when dealing with new providers.

Conclusion

CEX and DEX are complementary rather than mutually exclusive. Centralized exchanges excel at onboarding, fiat access, and customer support; decentralized exchanges excel at self-custody, privacy, and composability. The “right” choice depends on your objective, tolerance for risk, and desire for convenience versus control. What matters most is the net outcome after fees, the reliability of the provider, and the safety of your funds.

ExFinder.io brings clarity to this decision. By aggregating offers from top crypto exchangers and surfacing low exchange fees, transparent limits, and real user feedback, it helps you decide where to buy Bitcoin, swap stablecoins, or cash out—all with fewer clicks and fewer surprises. Use the listing to filter, compare, and then execute on the venue that matches your needs today.

Visit ExFinder.io to compare the best exchangers right now.

FAQ

1. What’s the quickest way to buy Bitcoin today?

Use ExFinder.io to compare verified fiat on-ramps or CEX card purchases. Check the final “you receive” amount after all card and platform fees.

2. Which is safer: CEX or DEX?

Both can be safe if used correctly. CEX relies on platform security and your account hygiene; DEX relies on smart contract quality and your wallet practices.

3. How do I minimize fees?

Choose networks with low gas costs, avoid unnecessary hops, and compare spreads. ExFinder.io highlights low fees crypto exchange routes.

4. Can I exchange fiat without KYC?

Most compliant fiat providers require KYC. If privacy is a priority, consider crypto-only routes on DEX after you’re funded in crypto.

5. What should I check before a large transfer?

Confirm the network, limits, and destination address, then run a small test transaction first. Enable 2FA and use hardware wallets for storage.

6. Are DEX aggregators better than a single DEX?

Often yes for price execution—they route across multiple pools to reduce slippage, but you’ll still pay gas and approval costs.

7. How does ExFinder.io make money?

Through listings and partnerships. It doesn’t take custody of funds or execute trades; it helps you discover and compare options.