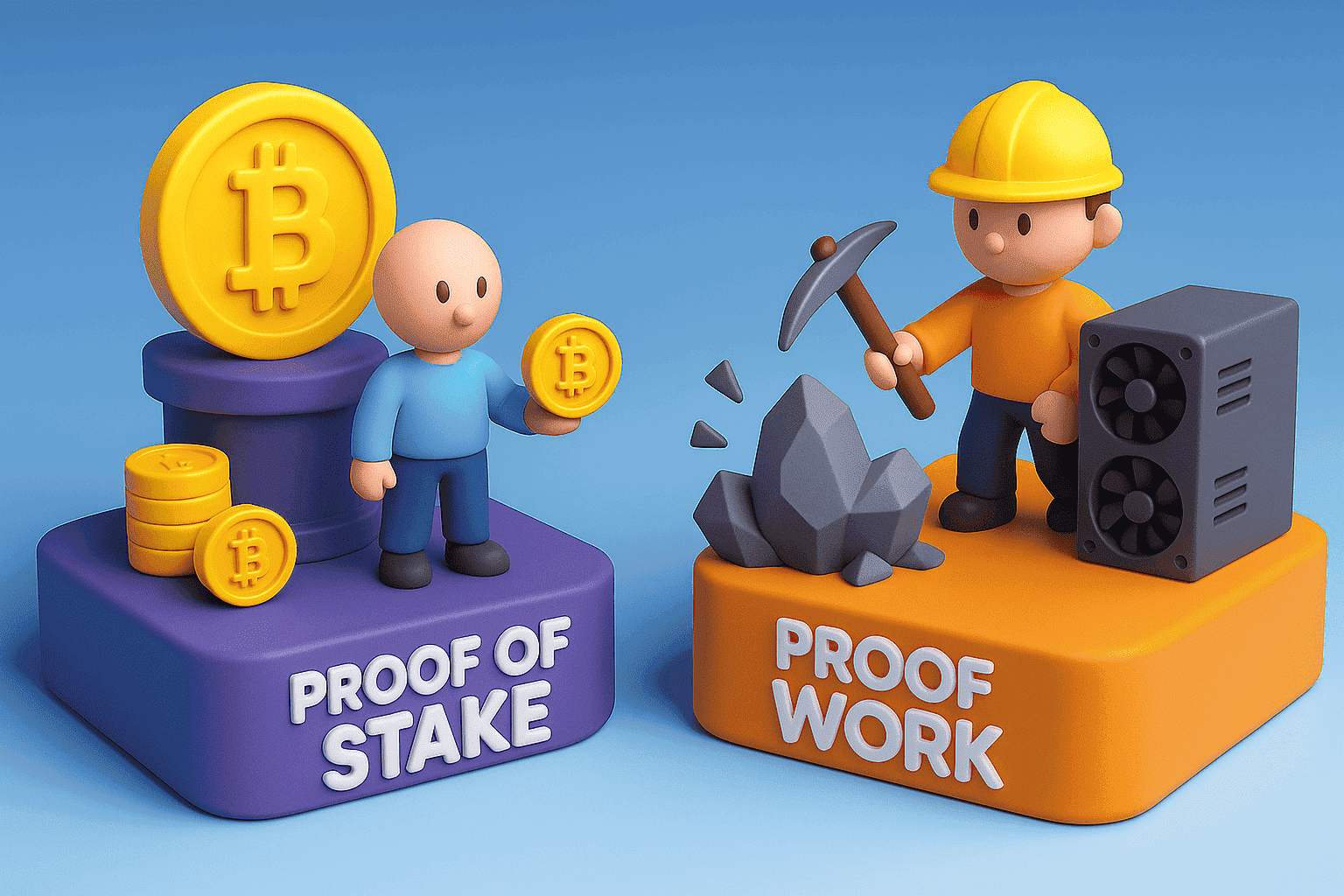

Proof of Work (PoW) and Proof of Stake (PoS) are the two most widespread consensus algorithms. They influence transaction speed, energy bills and even the question where to buy Bitcoin profitably before any fiat-to-crypto exchange. The table below gives a snapshot, followed by an in-depth look at how each model shapes fees on top crypto exchangers, liquidity on the best crypto exchanger and the daily flow handled by reliable crypto exchangers.

| Criterion | Proof of Work | Proof of Stake |

|---|---|---|

| Core idea | Miners solve hash puzzles, spend energy | Validators lock coins, confirm blocks |

| Energy use | High (≈ 0.1 % of global power) | Low (≈ 99 % less than PoW) |

| Reward model | Block subsidy + fees to miners | Staking yield + fees to validators |

| 51 % attack cost | Buy 51 % hash rate hardware + power | Buy 51 % stake (risk of slashing) |

| Main networks | Bitcoin, Litecoin, Kaspa | Ethereum 2.0, Cardano, Solana |

1. How Proof of Work Operates

In PoW, miners brute-force a hash below target, burn electricity and claim the reward. Energy bills are huge, so miners often rush to top crypto exchangers to liquidate freshly mined coins at a low exchange fee. Slow block times mean users sometimes queue, yet security has proven rock-solid since 2009, keeping Bitcoin the flagship asset on every best crypto exchanger.

PoW Strengths

- Battle-tested security for 15 years.

- Open competition maintains decentralisation.

- Simple incentive: fees plus block reward.

PoW Weaknesses

- Massive power draw and hardware waste.

- Lower throughput and higher latency.

- Regulatory pressure over CO₂ emissions.

2. How Proof of Stake Works

PoS replaces energy with capital. Validators lock native tokens and earn yield for honest behaviour. After Ethereum’s Merge, traders flocked to reliable crypto exchangers to swap into ETH2 without ballooning spreads, confident that the best crypto exchanger would list new staking tokens on day one. Lower energy cost also lets USDT exchangers bundle staking products while still advertising a low exchange fee.

PoS Strengths

- Energy footprint ~1 % of PoW chains.

- Faster block finality, cheaper gas.

- Passive income via staking rewards.

PoS Weaknesses

- High capital threshold (32 ETH per validator).

- “Rich get richer” centralisation risk.

- Complex penalties; slash wrong and funds vanish.

3. The Climate Narrative

Whenever tweets slam Bitcoin’s carbon trail, capital pivots to PoS assets. Liquidity soars, allowing top crypto exchangers to keep a low exchange fee, and users re-evaluate where to buy Bitcoin profitably versus staking coins for greener optics.

4. Security Economics

In PoW a 51 % attacker needs majority hash rate—hardware plus electricity. In PoS the attacker buys most coins, typically through a massive fiat-to-crypto exchange that any reliable crypto exchangers will flag. Either way cost remains high, yet PoS defence is directly tied to token price, so a market crash can lower the security bar.

5. User Impact and Trading Reality

PoS networks often post sub-cent fees, so arbitrage bots decide where to buy Bitcoin profitably based on bridge cost into or out of L2. PoW networks pay more per transaction but still dominate cold-storage strategy for long-term holders, who value time-tested immutability over raw speed on a best crypto exchanger order book.

6. Hybrid and Niche Designs

Dash mixes PoW with masternodes; Cardano runs Ouroboros PoS; Algorand uses Pure PoS with VRF. Each hybrid still lives or dies by liquidity funnels run by top crypto exchangers, because traders care about exit ramps and a steady low exchange fee more than about white-paper theory.

7. Mining Profitability in 2025

ASIC payback now hinges on sub-$0.06 / kWh electricity plus a deep OTC desk on reliable crypto exchangers. Many retail users skip rigs altogether, choosing a simple fiat-to-crypto exchange and self-custody cold wallet—often the most practical way to hold scarce assets and avoid hardware headaches.

FAQ

- Why is Bitcoin still PoW? — History and unmatched security.

- Where to buy Bitcoin profitably with minimal spread? — Any best crypto exchanger offering 0 % maker fees.

- Is PoS less decentralised? — Depends on stake distribution.

- Does the low exchange fee rise after KYC? — No, VIP tiers often drop it further.

- How to choose an exchanger for staking? — Seek licence plus Proof-of-Reserve.

- Why do USDT exchangers matter for PoS chains? — Fast swaps between ecosystems.

- Can a fiat-to-crypto exchange happen without KYC? — Up to €1 000 in many regions.

- Is home mining still profitable? — Only with ultra-cheap power.

- Are PoS gas fees always lower? — Usually, though heavy congestion can spike costs.

- Did all top crypto exchangers support the Ethereum Merge instantly? — Yes, to avoid fork chaos.

- Which model suits Play-to-Earn games? — PoS, thanks to quick block times.

- Could PoW chains switch to PoS? — Technically yes, politically tough.

- Does consensus affect token price? — Merge news can trigger rallies or dumps.

- Will reliable crypto exchangers cover slashing losses? — Only if Terms of Service say so.

Conclusion

PoW and PoS solve the same trust puzzle with different trade-offs. When you compare liquidity, tax rules and fee schedules, remember that top crypto exchangers with a consistently low exchange fee remain the critical bridge. Once you decide where to buy Bitcoin profitably or grab a PoS staking token, store funds safely or stake them via reliable crypto exchangers to get the best of either consensus world.