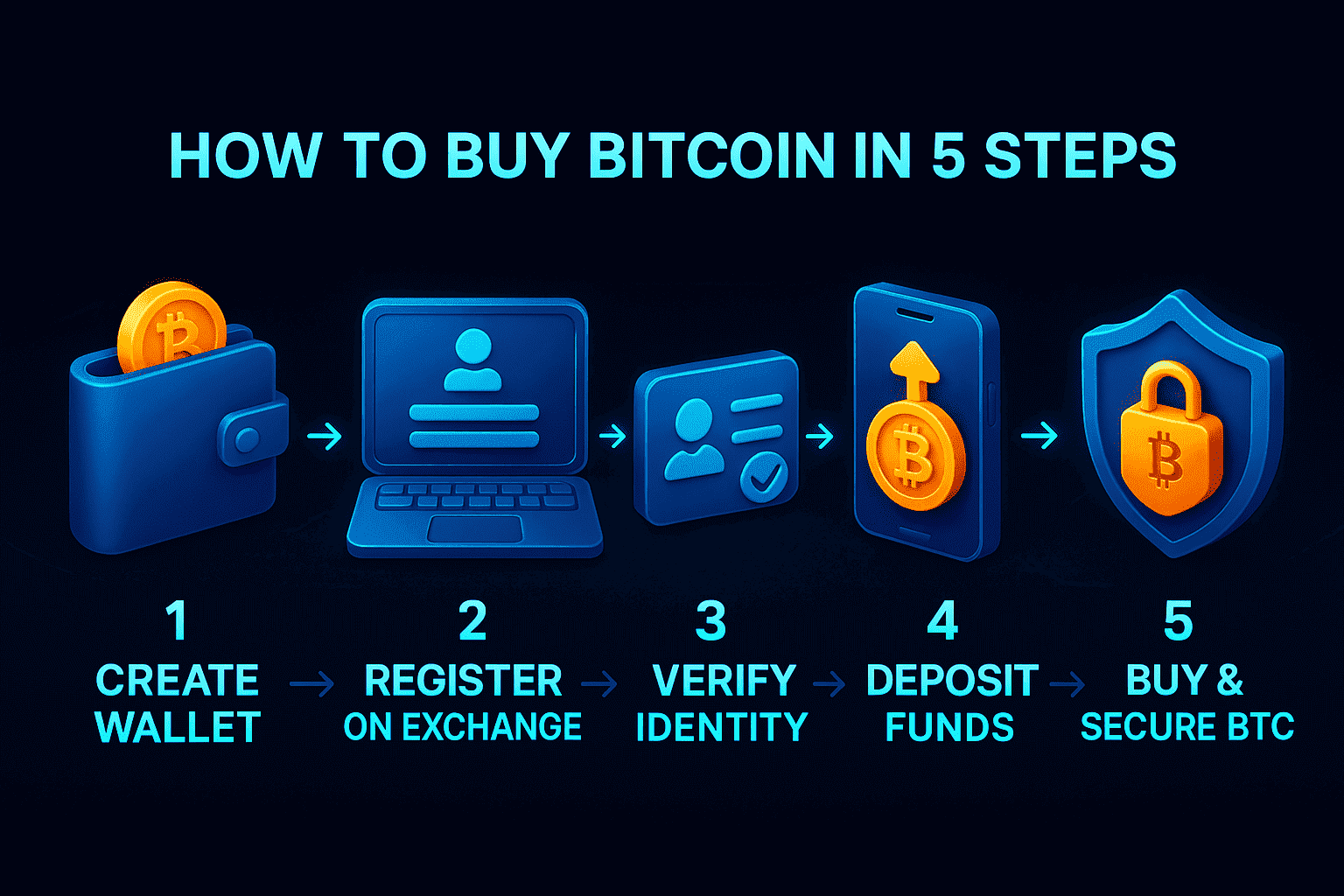

Buying Bitcoin in 2025 is easier than ever—if you follow a clear plan. This tutorial walks you through five practical steps that thousands of newcomers use each week. You will discover where to buy Bitcoin profitably, how a fiat-to-crypto exchange works on the best crypto exchanger, and why only reliable crypto exchangers with a consistently low exchange fee deserve your business. Every example is based on data from top crypto exchangers, so you can start safely within minutes.

| Step | Action | Pro Tips |

|---|---|---|

| 1 — Choose a platform | Create an account on a reliable crypto exchanger | Licence, Proof-of-Reserve, deep liquidity |

| 2 — Complete KYC | Unlock higher limits | Instant AI checks, data encryption |

| 3 — Deposit fiat | Bank transfer, card or P2P | Watch bank fees and cut-off times |

| 4 — Place your BTC order | Market or limit trade | Use pairs such as BTC/USDT for tighter spreads |

| 5 — Withdraw to a wallet | Store in hot or cold storage | Back up seed phrase offline |

Step 1. Pick a Reliable Platform

Google will spit out hundreds of results for “top crypto exchangers,” but focus on daily volume, licence status and whether the site publishes real-time reserves. The best crypto exchanger typically offers both card rails and local bank wires, plus BTC/USDT and BTC/EUR books with a low exchange fee. Before you decide where to buy Bitcoin profitably, confirm that the dashboard lists clear maker-taker fees and that USDT exchangers are integrated for flexible swaps.

Step 2. Finish KYC for Higher Limits

Most reliable crypto exchangers let you test the waters up to €1 000 without ID, but real limits arrive only after KYC. Upload a passport photo and live selfie—approval on top crypto exchangers now averages under ten minutes. Verified users enjoy daily withdrawals above $100 000 while keeping the same low exchange fee. That is a key reason many tutorials on how to choose an exchanger rank KYC speed ahead of sign-up bonuses.

Step 3. Add Fiat Funds

- SEPA/SWIFT. Ideal for amounts above €3 000; fees range 0–0.5 %.

- Bank card. Fast but 1–3 % processing; sometimes waived during promos.

- P2P desks. Work well in emerging markets; always inspect escrow rules on reliable crypto exchangers.

A quick fiat-to-crypto exchange credits your balance in seconds. If you wonder where to buy Bitcoin profitably with zero surcharge, watch the transfer scheduler: deposits landed before the bank cut-off often get an extra rebate on the best crypto exchanger.

Step 4. Execute the Bitcoin Purchase

- Open the trading terminal on your chosen top crypto exchangers.

- Select BTC/USDT or BTC/local-fiat.

- Place a limit or market order; check that the low exchange fee of 0.1 % or below applies.

Many USDT exchangers provide a dollar-cost-average tool that buys small BTC batches weekly. Auto-DCA keeps you on track even during volatility. Remember: tight books on a best crypto exchanger minimise slippage and help answer the recurring question of where to buy Bitcoin profitably no matter the time zone.

Step 5. Secure Your Bitcoin

Leaving large sums on an exchange invites risk. Hot wallets (Exodus, Trust Wallet) are OK for coffee-money transfers, but long-term holders prefer hardware devices. Every reliable crypto exchangers now supports SegWit addresses, saving 20–30 % in network fees—a tiny yet welcome boost to your effective low exchange fee.

Safety Checklist: How to Avoid Scams

- Use 2FA and bookmark the official URL of your best crypto exchanger.

- Never share seed phrases; staff at top crypto exchangers will not ask.

- Verify withdrawal whitelists—some reliable crypto exchangers offer wallet-address locks for free.

FAQ

- How long to buy BTC? Ten minutes end-to-end if KYC is instant.

- Can I skip KYC? Up to €1 000, but limits on a fiat-to-crypto exchange stay low.

- Where to buy Bitcoin profitably without card fees? — SEPA on the best crypto exchanger.

- Why care about a low exchange fee? Small fees compound and erode gains.

- Are USDT exchangers safe? Yes, when Proof-of-Reserve is public.

- What if BTC price crashes? Consider DCA instead of panic selling.

- Which wallet for beginners? Hot wallet with a 12-word seed.

- How to avoid phishing? Bookmark your top crypto exchangers.

- Can I buy less than 1 BTC? Yes—minimum trade is 0.00001 BTC.

- How high are network fees? Roughly 0.0001 BTC per withdrawal.

- Taxes? Check local CGT rules; many reliable crypto exchangers export CSV files.

- How to choose an exchanger with cash-back? Compare VIP tiers and trading volumes.

- Do I need a VPN? Only if crypto sites are geo-blocked.

- Do top crypto exchangers have mobile apps? Yes—iOS and Android are standard.

Conclusion

Five steps stand between you and your first satoshis: select a reliable crypto exchanger, pass KYC, fund the account, execute a trade, and move funds to a private wallet. By sticking with top crypto exchangers that publish reserves and deliver a consistently low exchange fee, you never have to guess where to buy Bitcoin profitably. Follow the checklist, secure your keys, and let the best crypto exchanger handle the heavy lifting while you focus on building a resilient portfolio.